I haven’t been posting much in the last few months. A combination of a suddenly increased workloads and a few family issue have distracted me from this.

And then, as the pandemic seemed to at least relent its grip, Putin pulled this out of the (fur) hat.

I hate this kind of surprises(I guess Ukrainians hate this even more), and as anyone else I was taken by surprise from this. I thought ok, he is saber rattling, he would not be such a tool as actually invading Ukraine. Man, how wrong I was. anyway, I am no expert in geopolitics, neither I am in the head of crazy waning super-power ruling dictators, hence that’s about it as my comment goes. I just hope this madness goes away, fast.

But although my geopolitics is not my cup of tea and I detest actively anything military, trade is my thing so to say.

I have been even interviewed on the Italian radio about the topic, following a series of tweets that went viral, God knows why, though.

The topic? Grain.

See, the thing is, while our media has been having a collective orgasm over wars, and tanks, and strategy, I have been concerned with something more mundane, but that I actually I have a slant understanding of. Wheat.

See, the thing with wheat is that is a global market, and both Russia and Ukraine produce a whole lot of the stuff. How much? to keep it simple, let’s say around a third, of the world supply. now it does not take a genius to understand what does that mean for the world markets…

If this situation does not get solved fast (and the chance of it solving fast are waning by the day) the summer harvest might not, or partly not, reach the world markets.

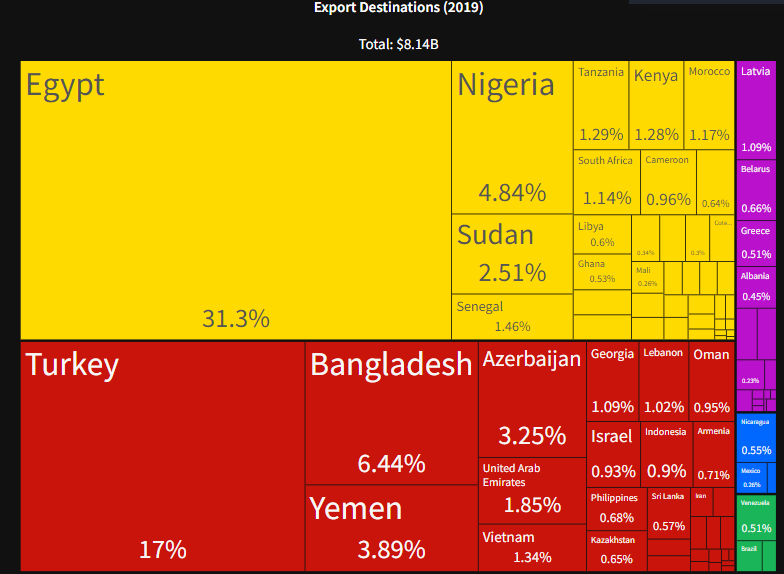

so here is a picture of how much some countries (biggest importers) rely on Russian imports.

Egypt alone takes home about 31%. Nigeria 5%, Turkey 17%. What have most of these countries have in common? they have a high population, a high proportion of which is poor, and hence spends a higher portion of its meager earnings on food.

In the EU and the West in general we will be, somehow, able to substitute grains from Russia and Ukraine with other sources (US, Canada, South America). We will do so at a higher price, but so be it.

However, what might be an inconvenience for a rich country, might be a downright nightmare for a poor one.

and then, to make things more fun, there is the issue of fertilizers: the market for fertilizers was already tense at the end of 2021, as I was discussing here

Now, with gas prices (a key element for the production of fertilizers) through the roof and a good chunk of the potash (another key element) coming from Belarus (already under sanctions) and Russia itself, the inflation of prices, even in other geographical areas, due to the increased costs for farmers, is practically a certainty. and with the high prices of fertilizer, farmer might be forced to reduce its usage, hence reducing the yield per acre of cultivation and further putting supply under strain.

Ah, and lest we forget sunflower oil, a staple in many developing countries, 80% of which comes either from Russia or Ukraine.

and if all of the above is going to be a huge issue for developing countries, for North Africa, the Middle East and the Indian sub-continent might be a downright tragedy.

We tend to forget in fact that high food prices, has always contributed to political upheaval: the “Arab spring” riots of 2011 started, essentially, as the flaring of discontent for high food prices.

Hence Europe be better prepared for further migration waves, on top f the massive influx of Ukrainian refugees coming in because of this bloody war.

It is not realistic to stem a tide of migration with a food crisis, and maybe even a famine, going on.

so what am I suggesting? Well, I hope that developed countries will not be so egoistic and shortsighted as to develop some form of help for poorer countries. Because even countries that are not participating in the western sanctions, will have a hell of a hard time securing the financing to buy goods coming from Russia. whereas Ukraine is unlikely to be able to export anything due to the destruction of infrastructure that the Russians are causing, Russia might be theoretically able to export, yet banks, mostly western and Asian, who provide trade financing, are unlikely even to issue a letter of credit. For certain parties’ prepayment might be an option, but not many operators in the developing world have that kind of financial firepower.

Let’s be clear: I am not suggesting to remove sanctions. But as we, egoistically, have spared oil&gas from the first wave of sanctions because we need these commodities for the running of our economies, we should find a way to get food to the other nations.

It is not charity: it is in our geopolitical(I HATE this word) interest.

For the time being, this is what the market looks like. Enjoy your week, fellas.

my Thoughts and prayers to the people of Ukraine (and to the poor people of Russia, too). Hope that reason prevails, and this senseless bloodshed might be stopped as soon as possible, and with the least amount of human life loss.

Leave a comment