The 100 million question (Barrels, not dollars. In dollars is a lot more)

King oil is dead, long live the king. Or is it?

In the last few months, between price wars and the lockdown, seems like there has been a never ending stream of bad news on the oil market (and on all commodities, for that matter.

Seems like we have entered the beginning of the end for Big oil. Or so many pundits would like you to believe. I have read, for example, an interesting interview to Jeremy Rifkin (link here https://www.dw.com/en/taking-a-look-at-jeremy-rifkins-the-green-new-deal/a-50752788) where the economist chimes in announcing the fact that, and I quote “fossil fuel civilization’ on cusp of collapse”

Well, I usually have a problem with this kind of apocalyptic quotes. My problem is that they are essentially exaggeration if not downright lies. And they are especially pernicious lies since they are addressed at the taxpayers of rich country where it might seem like we could really do away with these pesky fossil fuels to replace it with something else. At the taxpayer expense, of course.

Now the problem is, as usual in life, that things are a bit more complicated than that. For a start, fossil fuels have, in the last 100 years, underpinned an unprecedented economic boom that has essentially allowed for the world population to explode because they have made available cheap energy, chemicals and fertilizers.

Make no mistake, I agree with Rifkin and the scientific community that the path we are on is absolutely unsustainable, and something must be done to address climate -change related issues, the sooner the better. Where I have a problem is with inflated arguments, especially when said they come from certain interest groups, and I find them especially more hideous when said interest group are trying to exploit a crisis which is endangering the livelihood of million of people across the planet.(see https://www.nytimes.com/2020/04/22/world/africa/coronavirus-hunger-crisis.html). So in essence, I believe the priorities should lie elsewhere. On top of this I believe that the oil crisis is going to affect us geopolitically in ways that are difficult to fathom. So let’s say that the electrification of the car business is not exactly the first point that comes to mind, at least to my illiterate eyes. But I am digressing.

I am all in favor of speeding up the transition in renewables and to a green economy. But coming back to the title of this article, there is a lingering question, a simple one at that, at least in terms of understanding, that we need to answer.

How are we going to switch off from a 100 million BOE of consumption per day?

And that is only the liquids. We need to add on top of that about a third, give or take, of BOE of energy consumption produced through natural gas, which, although less carbon intensive than oil or coal, is still essentially a fossil fuel ie greenhouse gas producing source of energy.

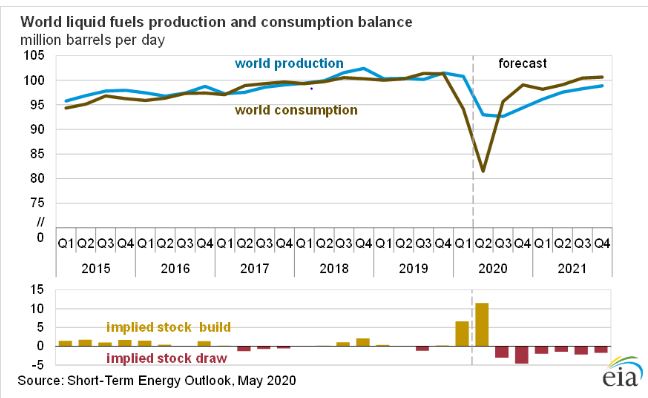

Today, as per the EIA website, the consumption has fallen to about 80 million barrel.

. The forecast the EIA is producing sees a return to above 90 million barrel by Q3. Although lower than the previous peak, that is still a lot of oil to come out of the ground, even considering the inevitable run down on inventory that must follow the huge build-up if the last few months.

And it is way above what an healthy planet needs.

On one side I believe the EIA forecast to be quite optimistic, as the economic fall-out of this pandemic is going to be felt much beyond the current fiscal year. However talking of the “collapse of the fossil fuel based economy” is disingenuous at best.

For example: electric cars.

One of the solutions hailed for the reduction of our carbon footprint is the acceleration of the switch to electric based mobility.

Now, there is one glaring and very important advantage of electric mobility over oil-based one: the electric car will do wonders to ease the local pollution in our city. However we need to consider one thing. What is, ultimately, an internal combustion engine? It is a power generator. It generates Kw of power that is used to power our cars. Switching from a localized fuel-based production source, to a remote one requires essentially 2 things: generating that power, storing it if needed and transmitting to the point of recharge. If we consider the number of cars involved, assuming a constant level of cars (which is fair in the OECD, not so much in emerging countries) it is a whole lot of power generation that needs to be added, and a whole lot of investment needed in the grid to transmit it reliably. Can this be achieved only via renewables? I doubt it, especially considering the unreliability of certain production sources (think wind and solar) and the political backlash that mega wind projects are facing also for their not exactly small local environmental impact.

For example in Germany, one of the leading countries in energy transition, wind power generation expansion has essentially stalled. (see: https://www.dw.com/en/german-wind-energy-stalls-amid-public-resistance-and-regulatory-hurdles/a-50280676) this is not good news. And this somehow contradicts the proponents of the green new deal.

That baseload question.

The question when it comes to electricity production and consu,mption revert around one big topic: baseload, the permanent minimum load that a power supply system is required to deliver.

Some studies are starting to reject the concept of baseload, however for the time being I will stick with the conventional wisdom. Adding more consuming items ie Cars, will inevitably lead to the need for a higher baseload requirement. And renewables such as wind and solar (whereas hydropower almost does not suffer from this drawback) are not very well suited to provide the baseload. Unless we assume that a lot of distributed generation capacity will be added to the equation (think solar power on your roof) to ease the demand on the generation capacity. And of course together with the generation, a form of storage needs to happen.

This is a great idea with a lot of potential. BUT… these system are not cheap. And imagining, at a time of economic hardship as the one we are going to experience, a massive investment on behalf of consumers is disingenuous. Can government pick up the tab? Yes, to a certain extent. However with dwindling economic activity comes dwindling tax revenue. Not to mention the fact, that, where new power generation is most needed, in emerging countries, government can barely pay their bills, let alone sustain investment.

Debt relief is as important as green technology to speed our green transition.

As we are talking, a record number of government in the emerging economies are flirting with default.(see: https://www.economist.com/finance-and-economics/2003/05/08/dealing-with-default) How is this connected to our question? Simple: most of these governments rely on extractive industries and other commodities to balance their budget. Again, dear green fellows: there is little to be gleeful about the collapse in the price of oil.

If we want to allow these governments to breath and to invest in the necessary infrastructure, such as reliable power generation and transition, we have to consider a massive debt relief program. Also because there is a good to fair chance that those debt will not be paid in full anyway (see: Argentina)

So am I suggesting the taxpayer in rich countries should foot the bill? Yes, that is exactly what I am suggesting. Is this a socialist/liberal policy? No. This is a good policy. Because especially if you are an rightwing extremist concerned about migration, you probably should understand that to stem the tide of migration and other climate-related disasters, the best way is to make sure that people have a good way to make a living here they are born. It is really as simple as that.

And now something completely different: the oil market!

So going back to our question, what is going to happen in the oil market? The answer is, I don’t know, and be very careful about anyone, even industry insiders, who tell you otherwise. It is really a difficult question to answer, as the moving parts are many and also self-influencing.

What we can try to do is to understand what has happened, and why.(of course for the sake of a blog post, I am going to take some short-cuts here. The aim of this article is to stir discussion, not to answer questions in detail).

First: negative price of oil, how bad it is? Is it really the end of the world as we know it?

The answer is simple, No. not even close. What is happening is an excess of supply of crude, coupled with a lack of supply of storage and a fall in demand.

Sounds simple right? It is, at least in concept. Some people are gleeing about market failure, but if anything, the opposite is true. Markets are still the most efficient way to allocate resources. And if a resource is too plentiful (oil) while another is scarce (storage) the results is that prices move accordingly.

And to make my case, I can point out to the fact that the negative prices where only at one point in time, and only for WTI. Whereas for Brent based crudes, the prices, albeit depressed, staid in the realm of plausible.

Why is this? Because the 2 markets are different, and not substitute of each other. Hence the conditions, albeit similar, lead to very different results, in that for WTI the storage constrictions were so dramatic that the fall in demand led to negative prices for crude.

In the rest of the world, it has led to a spike in the cost of tankers, as traders are storing crude on ships waiting for the price to go up.

As for the supply, in both markets we have a vast oversupply, albeit corrections are being made.

In the rest of the world, most countries are taking dramatic steps to cut productions (and state budgets) and restore prices. Saudi Arabia is also increasing taxes and cut subusidies, as Russia is doing as well. This is a cause for relief for markets, but a cause for concerns for us as citizens: these countries regimes base their consensus on keeping their populations reasonably fed. We really do not want to have an instable nuclear power (Russia…anyone should have shivers in remembering Yeltsin’s Russia) or the biggest oil producer experiencing social upheaval. If history is of any guidance, social upheaval rarely ends well in the Middle East (see: Iran).

In the US, finally the chickens are coming home to roost for the shale oil industry. What has happened here is essentially a massive bubble of overinvestment tat has popped open. And the fall-out is not going to be pretty. And it is going to make waves well beyond the energy sector, especially in the banks that, awash with liquidity, have inundated the sector with cheap credit.

As a matter of fact banks will have to take over stranded energy assets (and they are already doing so see: https://www.reuters.com/article/us-usa-banks-energy-assets-exclusive/exclusive-us-banks-prepare-to-seize-energy-assets-as-shale-boom-goes-bust-idUSKCN21R3JI) which will lead to fire-sales, which will lead to losses to the banks, which might require further bail outs.

And that is exactly what government should not do. When there is an overinvestment bubble, the only rational way to react is to let the inefficient producers goes bust. But that is exactly what the US government is loath to do.

A last word: subsidies

Given what we have seen so far, there is a low hanging fruit that should be picked to start to fi this mess: fossil fuel subsidies, both direct and indirect. Fossil fuel subsidies must end, for good.

There is little economic justification for subsidies to certain industries even in the best of times, there is practically no justification now. If producers cannot be afloat on their own, resources and capital are better allocated elsewhere. Especially at a time of dwindling tax revenues and ballooning national debt, the case for fossil fuels subsidies is as low as it has ever been.

And I am not only talking about direct subsidies such as tax breaks and grants. I am also avocating for pricing environmental damage in the price of oil products, logistics and everything that comes out of this industry. Both theory and practice have demonstrated time and again that the market is the most efficient way to force behavior change and development of new technology. The role of the governments, now more that any point in time, is to ensure a functioning market that prices externalities correctly. This would in turn ensure both a correct allocation of capital and spurn the research in substitutes, being it telecommuting to reduce the cost of transport or re-shoring production closer where consumption happens. And would have the added benefit of being far to every user.

Conclusion: what is the answer to the 100 million question?

The conclusion is that there is not a single answer, rather a dire need of policy shift.

The following comes to mind:

- Find ways to reduce consumption. Reduction is the best. Less miles, longer use, more telecommuting. Every single action matters.

- Scrap subsidies, and let markets work their solutions

- Support economic growth, in different ways depending on policy goals. Stimulus is well and welcomed to let the world weather the Covid storm. Debt relief for developing country is also necessary. Geopolitical turmoil is a price and a risk to big to sacrifice it on the altar of political ideology

- Investment in power generation and transmission. Different needs require different solutions, so the key is in the mix.

- Oil cannot and will not die fast. The prosperity it has given us should be kept in mind. We need an intelligent transition, not a politically driven one.

Am I answering the question? Of course not. But starting a rational discussion is necessary, and never too late. Lest we leave the stage to extremists on both sides. And extremists, as the 20th century should have taught us, are never good at fixing things. Only at breaking them.

Leave a comment