While reading the press tonight I came across this very interesting piece of news. Apparently Occidental petroleum has entered a substantial hedging position following the acquisition of Anadarko.

This has been probably the highest profile M&A deal of the last few years and, as often in these cases, there are a few questions around both the assumptions, and the hurdles, to make this merger successful. Especially considering that both company have quite an overlap in their asset basis (shale explorer, geographies are extremely similar)

As a side to the operations, from the regulatory filings emerged that Occidental, as part of the bigger scheme to finance the transactions, has entered big position on to hedge against price of oil volatility.

What is amazing about this position is the sheer size of it. Occidental alone produces around 700K Boe per day. Which means that, to hedge such a production, the number of contracts involved are staggering.

According to market rumors, the main reason to enter these positions is to cover the cash-flow of Occidental following its acquisition.

(source: Reuters)

According to market rumors, the main reason to enter these positions is to cover the cash-flow of Occidental following its acquisition. According to memos circulated during the take-over by Anadarko, Occidental would have not be able to keep its dividend policy for the following 3 years. On top of that, the company has financed the acquisition through debt and through the issuance of preferred shares (mostly to Warren Buffet’s Berkshire Hathaway) with a dividend yield of around 8%. Carl Icahn, the billionaire corporate raider that many, including yours truly, would like to see retired, was campaigning heavily against the bid (even though, as usual in Icahn’s fashion, for all the wrong reasons).

This makes this a very expensive acquisition, as it is often the case, which rest its economic viability on a number of assumptions:

- Achieving substantial cost cutting and capital expenses synergies

- Reduce the cost of extraction of the combined companies(essentially Occidental is betting it can operate Anadrako’s wells more efficiently and drill at a lower cost.which is a bit at odd with the cut in CAPEX)

- Achieve a profitable dismissal of certain assets.

Another key element is the price of oil: Occidental is an up-stream companies foremost, and its results and cash-flow are hence heavily influenced by the price of oil.

Which lead to the topic of this article: these gargantuan hedge positions.

The first interesting bit is that pre-merger, Occidental had not hedge against price changes since 2005,

The first interesting bit is that pre-merger, Occidental had not hedge against price changes since 2005, since it believed this would have led to the danger of losing potential upside on revenues.

So why entering in such an agreement now, in such a short timeframe?

The first interesting to note is that, although the kind of operation that Occidental has engineered would be achievable theoretically thorough exchange listed products (we are talking about a construction of simple call and put options after all) it was carried out entirely over the counter.

Why OTC? First to be able to put together the volumes required in a short time-frame (alas before the Anadarko deal was completely closed, allowing the management to counter the rumors that Occidental could not keeping paying its dividends) and second because if the market would have known the scale of the contracts, rival traders could have taken position to increase the price of the hedge (hence profiting).

So, is there anything wrong in concluding such operations in an opaque way, over the counter, rather than on an exchange? In theory no. In practice the motivations behind this operation might be less than optimal, for the long term interest of the company at least. Why?

So, is there anything wrong in concluding such operations in an opaque way, over the counter, rather than on an exchange? In theory no.In practice the motivations behind this operation might be less than optimal

For 2 reasons, mainly:

- By going over the counter, the cost of the hedge might have been quite substantial, non so much in terms of fees(Occidental had identified this hedge, on its regulatory filing, as “costless”) but in terms of the potential profit which was left to the banks

- The mechanics of the operations, which stretch all the way to 2021, might not be, shall the market move in a certain way, completely positive to Occidental. Will get into the details later.

So essentially my personal point of view is that, although I understand the logic of keeping investors happy by being able to keep the dividend payments, this shall not come at the potential expense of the long term health of the company and its other stake holders (this would be a whole discussion on the term of shareholder value that would be way to long for a post like this). And second, by putting this hedge in place, Occidental has essentially take position on the oil market by betting that the price will not increase above a certain level (more on this later). Which kind of defeat the purpose of hedging. Plus what I find a bit puzzling, and I saw this in my professional practice in the past, is the concept of creating a corridor. I understand that a production company might want to put a floor on the price at which it sells its oil, however why putting a limit on the potential upside?

The answer here has less to do with the industrial logic of the investment and more with the need to give the banks the potential to earn additional fees and, possibly, although I am not sure about this, to collect the upsides shall the price go above the Cap in the corridor. At the end of the days, both the banks and other subjects involved in the M&A deal had put substantial effort in the game, hence they need to be remunerated. Which again open the questions on whether this merger really made any sense (if the history is any guidance, most likely no). However, this goes beyond the point of looking at this hedge.

So, the hedge itself, how does it work?

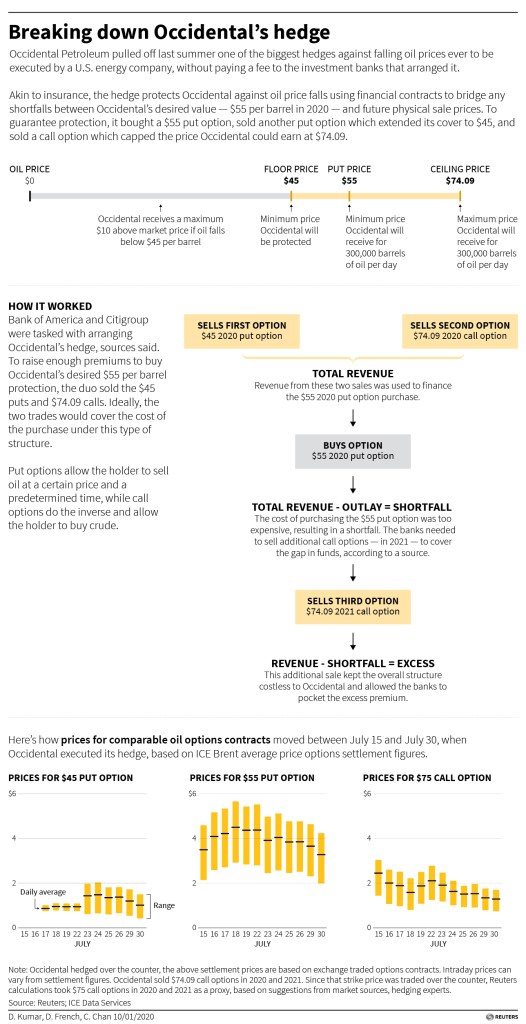

In simple terms what Occidental has done is to create a price corridor at which it will sell its production, with a minimum price of 45 USD per barrel and an maximum of 74.09.

The bulk of the hedge itself is actually aimed at preserving Occidental desired value of 55 USD a barrel, which is the level at which the cashflow of the combined entities, shall the mergers synergies materialize, will ensure a cash flow copious enough to meet its debt obligations and keep its dividend commitment.

So why limit the potential upside? At the end of the day, shall the price go above 74 USD, Occidental would collect an higher cash-flow and achieve better results.

The major issue is that this, being a private transaction and hence in illiquid markets, will cost intrinsically more than going through an exchange. Hence the full “package” of options sold to put in place the Floor, was paid, in all or in part by selling the opposite contract (the Cap at 74)

So how does this whole construct work?

The first leg of the operation is a put option (a contract where Occidental has the right to sell at a given price) at 55 USD covering 300 thousand barrels per day of production through 2020.

Now, considering that actually Occidental produces a much higher volume daily, so in the end it bought an additional put at 45 USD a day.

This should ensure that the price of oil stays in the desired range for the whole 2020.

Here comes the necessity of the Cap. To avoid paying the exorbitant fees that would normally be required to conclude the options that were put into place to ensure the floor, the company has sold the sold the Cap option (allowing its counterparties essentially to cover the risk of oil going above 74 dollars) not for one but for 2 years. Which means that whereas the downside of ta low price environment is limited for a year, the potential upside is limited for 2.

Which essentially tells us that the company hopes or believes the price will stay under 75 dollars for the next 2 years (and actually believes it might go under 55) whereas its counterparties believe exactly the opposite.

This operation has allowed the management of Occidental to qualify the hedge as “costless”.

However this claim is a bit disingenuous: shall the price of oil stay above 74 Dollars for an extended period of time, a thing that is not unthinkable, considering for example the tensions in the gulf, the cost in lost revenues might significant.

This operation has allowed the management of Occidental to qualify the hedge as “costless”.However this claim is a bit disingenuous: shall the price of oil stay above 74 Dollars for an extended period of time the cost in lost revenues might significant.

Which brings us back to a different point: in many circles there were serious questions about the merits of this mergers. Occidental management has doggedly pursue the deal, and in doing so, has stretched the financial health of the company quite substantially, by seemingly trying to acquire a big target AND keep its dividend policy unaltered, thus following two contrasting objectives.

On top of that, the success of the mergers relies on a number of factors which are all but a given to happen. Whereas the costs are real. This is a situation that in the past has rarely eneded up very well for the company involved.

So my hope, is that at least the compensation of Occidental CEO is structured in a way that she pays a price, shall the deal turn out to be dud. I am not holding my breath on the matter though. When a CEO pursues a deal the benefit of which are not so obvious, while the cost are, her motivations might be not necessary aligned to the interest of the other stakeholders.

Leave a comment